how to earn points on Walmart credit card has become one of the most effective ways for frequent shoppers to increase cashback rewards. The Walmart Rewards system, managed through Capital One,

enables cardholders to accumulate points on qualified purchases at Walmart stores, Walmart.com, and other participating merchants. With proper planning and consistent use, those points convert into significant savings or statement credits.

Contents

What Is Earn Points on Walmart Credit Card?

Knowing how to earn points on Walmart credit card begins with recognizing how the Walmart Rewards Program functions. The program runs through two main cards Walmart Rewards® Mastercard® and the Walmart Store Card.

Both cards enable the accumulation of rewards, but their use cases differ slightly. The Mastercard functions everywhere Mastercard is accepted, while the Store Card applies only to Walmart purchases, including online and fuel stations.

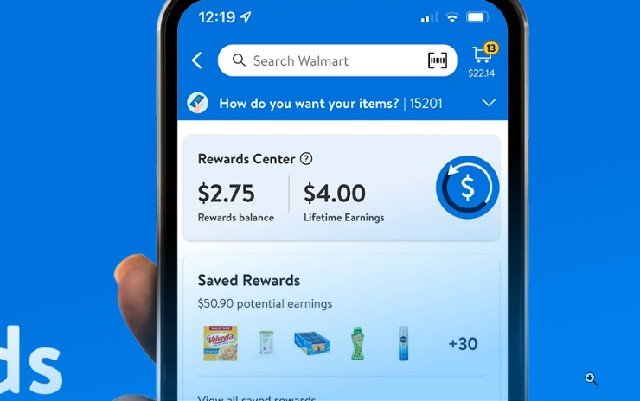

Each purchase adds reward value in the form of points that represent real monetary credit. For instance, every dollar spent at Walmart.com earns a higher return than transactions made elsewhere. The points can be redeemed for Walmart.com purchases, gift cards, or account credits through Capital One’s reward portal.

Requirements to Earn Points on Walmart Credit Card

Before applying the approach of how to earn points on Walmart credit card, several conditions and setups are necessary to ensure eligibility for earning and redemption.

First, an applicant must qualify for a Walmart Rewards® Mastercard® or Walmart Store Card. Both are available directly through the Walmart or Capital One website. Upon approval, linking the card to a Walmart.com account and enabling Walmart Pay ensures the full reward rate for in-store and digital purchases.

- Apply for the correct card type based on shopping habits.

- Create or log in to the Walmart.com and Capital One accounts.

- Activate Walmart Pay inside the Walmart app for in-store transactions.

- Review the reward rate structure: 5% back on Walmart.com, 2% at Walmart fuel stations and in-store using Walmart Pay, and 1% elsewhere with the Mastercard.

- Familiarize with reward terms to verify which purchases qualify for points.

Each setup stage ensures that every qualifying purchase contributes toward higher cashback potential. Proper preparation avoids missed earnings or lost rewards due to incomplete activation or account linkage

How to Earn Points on Walmart Credit Card Via App Purchases

Online transactions generate the highest value when practicing how to earn points on Walmart credit card. Purchases made through Walmart.com or the Walmart App typically return 5% in Walmart Rewards points. This rate applies to groceries, electronics, and household products, enhancing the incentive for digital shopping.

The higher rate for online purchases stems from Walmart’s integration with Capital One’s digital payment infrastructure. The platform tracks eligible categories automatically, crediting rewards shortly after the transaction posts. Maintaining consistent digital purchases ensures maximum reward yield.

How to Earn Points on Walmart Credit Card Via Walmart Pay

Walmart Pay provides an additional earning advantage in-store. Linking the credit card within the Walmart App ensures transactions qualify for a 2% return. Shoppers using Walmart Pay scan their phone at checkout, which seamlessly applies both payment and reward collection.

Unlike traditional swiping, Walmart Pay eliminates the need to carry the physical card, improving speed and security. The digital payment system also reduces the risk of missed reward credits, as all transactions connect directly to the account.

How to Earn Points on Walmart Credit Card Via Buy Fuel

Fuel purchases often contribute meaningfully to annual rewards totals. Cardholders earn 2% back at participating Walmart and Murphy USA fuel stations. The earned points appear alongside other Walmart purchases on the Capital One rewards dashboard.

Frequent drivers can benefit from routing their fuel spending through Walmart’s network, creating additional cashback accumulation while managing daily expenses.

Use the Card Everywhere Mastercard Is Accepted

For those carrying the Walmart Rewards Mastercard®, every transaction outside the Walmart ecosystem still generates 1% cashback. The ability to earn rewards on groceries, dining, and travel extends value beyond Walmart properties.

Using the Mastercard version broadens spending flexibility, turning ordinary purchases into gradual point growth. It’s a strategic approach for anyone aiming to build consistent cashback volume without altering shopping behavior dramatically.

Pay Bills on Time to Keep Rewards Active

Rewards depend on account activity and standing. Late payments or delinquencies can result in forfeited rewards. Paying statements promptly ensures ongoing eligibility for earning and redemption.

Capital One’s digital interface enables automatic payments or alerts, minimizing the chance of missed due dates. Keeping accounts current protects accumulated points and maintains access to high-tier reward rates.

Point Value and Redemption After Earn Points

After mastering how to earn points on Walmart credit card, understanding reward value becomes essential. Each point typically equals one cent in purchasing power, meaning 100 points convert to one dollar of redemption.

Points can be applied toward Walmart.com orders, statement credits, travel bookings, or gift cards. The Capital One Rewards interface handles redemptions seamlessly, allowing instant application during checkout.

Walmart and Capital One occasionally introduce limited-time redemption boosts, granting more value for using points in specific categories such as groceries or electronics. Tracking promotional periods ensures that redemptions yield maximum benefit.

How many points can be earned on the Walmart Credit Card?

Cardholders receive 5% back on Walmart.com and app purchases, 2% with Walmart Pay or at fuel stations, and 1% elsewhere using the Mastercard.

Do Walmart Credit Card points expire?

Points remain active indefinitely as long as the account stays open and in good standing. Accounts with missed payments risk losing stored rewards.

Can Walmart points transfer to another account?

Transfers between accounts aren’t permitted. All redemptions occur within the same Capital One account linked to the card.

Is the Walmart Credit Card worthwhile for daily spending?

For regular Walmart shoppers, the high reward rate on digital and in-store transactions provides strong cashback . The Mastercard variant further enhances flexibility through external merchants.

What occurs if the Walmart Credit Card account closes?

Unused rewards become void once the account closes. Redeem accumulated points before cancellation to prevent loss.

For more insights , read How to Redeem Walmart Capital One Rewards Points for detailed methods on converting points into maximum cashback value.