how to buy Walmart stock directly online to gain ownership in one of the world’s largest retail corporations. Walmart Inc. remains a dominant force in retail, e-commerce, and logistics, making its stock a long-term favorite for dividend and value investors. Purchasing Walmart shares directly online enables access without intermediaries, providing flexibility, low fees, and the potential to reinvest dividends automatically.

Contents

- 1 What is buy Walmart stock directly online?

- 2 Requirements to buy walmart stock directly online

- 3 how to buy walmart stock directly online

- 3.1 1. Create and Verify Your Investment Account

- 3.2 2. Link Your Bank Account

- 3.3 3. Search for “WMT” or “Walmart Inc.”

- 3.4 4. Review Walmart’s Stock Information

- 3.5 5. Choose Order Type (Market or Limit Order)

- 3.6 6. Select Quantity or Fractional Shares

- 3.7 7. Confirm and Execute the Purchase

- 3.8 8. Enable Dividend Reinvestment (Optional)

- 4 Buying Walmart Stock Through the Direct Stock Purchase Plan

- 5 Buying Walmart Stock via Online Brokerages

- 6 Monitoring and Managing Your Walmart Investment

- 6.1 Can investors buy Walmart stock without a broker?

- 6.2 What is the minimum amount required for Walmart stock purchases?

- 6.3 Does Walmart distribute dividends to shareholders?

- 6.4 Is online stock purchasing safe for Walmart shares?

- 6.5 Can international investors participate in Walmart stock purchases online?

What is buy Walmart stock directly online?

Knowing how to buy Walmart stock directly online means understanding how individuals can acquire Walmart Inc. shares through digital platforms or direct purchase services. Walmart’s stock trades under the ticker symbol WMT on the New York Stock Exchange (NYSE). Investors may purchase shares via an online brokerage account or through a Direct Stock Purchase Plan (DSPP) managed by Computershare.

Walmart Inc. represents a global entity headquartered in Bentonville, Arkansas. The company operates thousands of retail locations worldwide and maintains a growing online marketplace. Owning WMT shares connects investors to the organization’s dividend program, market capitalization growth, and quarterly earnings.

The act of buying Walmart stock directly online involves digital verification, funding an account, and selecting the number of shares to purchase. The benefit lies in convenience and cost efficiency, as direct purchase programs reduce reliance on traditional brokers. Many platforms allow fractional share investing, enabling participation even with smaller contributions. Through a Dividend Reinvestment Plan (DRIP), investors can automatically reinvest earnings back into additional Walmart shares.

Requirements to buy walmart stock directly online

Before completing how to buy Walmart stock directly online, several items need preparation to ensure smooth execution. Essential elements include identification, banking access, and preliminary research.

- Valid government-issued identification for verification.

- A linked bank account to deposit funds or receive dividends.

- Secure internet connection to access brokerage platforms.

- Awareness of Walmart’s recent stock performance, earnings, and dividend yield.

- Understanding investment minimums, usually between $25 and $250 when purchasing through Computershare.

- Familiarity with payment systems such as ACH transfers or debit authorization.

- Reviewing regulatory oversight by the SEC for assurance of platform legitimacy.

Investors who prepare beforehand minimize delays during account approval. Additionally, exploring Walmart’s financial reports helps establish expectations for dividends and long-term stability.

how to buy walmart stock directly online

There are two main approaches for how to buy Walmart stock directly online: through a recognized online brokerage or via the official Direct Stock Purchase Plan. Each offers accessibility and transparency, though they differ slightly in fees and convenience.

1. Create and Verify Your Investment Account

An investor begins by opening an account through a verified online brokerage or Computershare. Registration includes submitting personal information and passing identity verification checks required by financial regulations. Once approved, the account provides full access to U.S. markets.

2. Link Your Bank Account

Connecting a checking or savings account allows funding and future dividend transfers. Most brokerages rely on ACH or debit transactions. Maintaining accurate account details ensures seamless purchases and withdrawals.

3. Search for “WMT” or “Walmart Inc.”

Within the platform, type “WMT” in the search bar. This ticker symbol identifies Walmart’s listing on the NYSE. Reviewing the company profile page displays real-time pricing, historical charts, and analyst ratings.

4. Review Walmart’s Stock Information

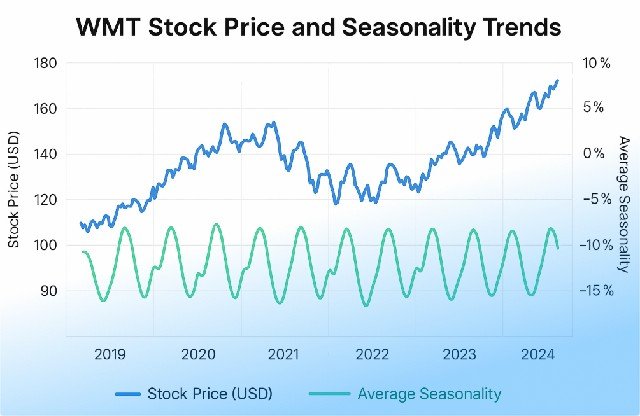

Before making a purchase, analyze Walmart’s valuation metrics such as P/E ratio, dividend yield, and market capitalization. Historical performance data provides insight into price stability and growth trends.

5. Choose Order Type (Market or Limit Order)

Decide whether to execute a market order or a limit order. Market orders buy at the current available price, while limit orders specify a maximum price per share. Choosing limit orders can prevent overpaying during volatile trading hours.

Online brokerages increasingly permit fractional share purchases, making it possible to invest smaller amounts in Walmart stock. This flexibility helps diversify portfolios without committing large capital.

7. Confirm and Execute the Purchase

After reviewing order details, confirm the transaction. Once executed, the shares appear within the portfolio dashboard. Ownership records automatically update within the brokerage system or Computershare account.

8. Enable Dividend Reinvestment (Optional)

Activating the Dividend Reinvestment Plan (DRIP) allows automatic reinvestment of quarterly dividends into new Walmart shares. Over time, this strategy compounds growth and increases shareholding without additional deposits.

Buying Walmart Stock Through the Direct Stock Purchase Plan

Another way to complete how to buy Walmart stock directly online involves using the Direct Stock Purchase Plan administered by Computershare. This service enables direct investment in Walmart without requiring a brokerage intermediary.

- Access the Computershare Walmart page.

- Register an account and provide identification for verification.

- Fund the account with the minimum contribution, generally $25 to $250.

- Choose whether to schedule recurring monthly contributions.

- Confirm transaction details and review the confirmation notice.

The Direct Stock Purchase Plan provides convenience for long-term investors seeking consistent contributions. Automatic reinvestment of dividends further enhances portfolio growth. Additionally, Computershare applies lower administrative fees compared to most retail brokerages.

Buying Walmart Stock via Online Brokerages

Modern brokerages simplify how to buy Walmart stock directly online for investors preferring advanced trading interfaces and mobile access. These platforms provide research tools, real-time analytics, and secure transactions.

- Register on leading services such as Fidelity, Charles Schwab, Robinhood, or E*TRADE.

- Complete identity verification and link a funding source.

- Search for “WMT” and view current share data.

- Select “Buy,” specify investment amount, and review commission details.

- Confirm and finalize the trade within the application interface.

Brokerages provide extensive tools for portfolio monitoring and automatic reinvestment. Many allow recurring purchases, price alerts, and financial news updates. Investors also gain access to additional securities such as ETFs, bonds, and mutual funds to complement their Walmart holdings.

Monitoring and Managing Your Walmart Investment

After completing how to buy Walmart stock directly online, consistent monitoring ensures alignment with personal financial goals. Using tracking tools and setting up alerts aids decision-making.

- Track real-time stock movements through Yahoo Finance, Google Finance, or the brokerage dashboard.

- Enable email or mobile alerts for major price swings or dividend declarations.

- Review quarterly earnings reports published by Walmart to assess performance.

- Reinvest dividends or take cash distributions based on long-term objectives.

- Periodically rebalance portfolios to maintain risk control and diversification.

Walmart releases detailed financial updates each quarter, enabling investors to evaluate profitability, growth, and dividend reliability. Observing these updates helps determine optimal holding periods and potential selling opportunities.

Can investors buy Walmart stock without a broker?

Yes, Walmart’s Direct Stock Purchase Plan, managed by Computershare, enables direct online purchases without using a traditional brokerage account.

What is the minimum amount required for Walmart stock purchases?

Computershare’s plan typically accepts initial investments between $25 and $250, depending on transaction frequency.

Walmart pays quarterly dividends, which may be automatically reinvested through the Dividend Reinvestment Plan (DRIP).

Purchasing through regulated entities such as Computershare, Fidelity, or Schwab ensures compliance with SEC standards and data protection measures.

Can international investors participate in Walmart stock purchases online?

Yes, global platforms like Interactive Brokers and eToro provide access to U.S. equities, including Walmart (WMT), for international clients

Those researching retail investment opportunities may also explore how to check what walmart has in stock for insight into inventory management and market .